This post has been read 2546 times!

Update: December 13, 2011

As we first reported a year ago, the U.S. usage rates of Facebook is way down, per the New York Times article. This is very bad for the hyped valuation and why they shunned the openness of the IPO process.

The article reads, ”

But the figures on growth in this country are stark. The number of Americans who visited Facebook grew 10 percent in the year that ended in October — down from 56 percent growth over the previous year, according to comScore, which tracks Internet traffic.

Ray Valdes, an analyst at Gartner, said this slowdown was not a make-or-break issue ahead of the company’s public offering, which could come in the spring. What does matter, he said, is Facebook’s ability to keep its millions of current users entertained and coming back.

“They’re likely more worried about the novelty factor wearing off,” Mr. Valdes said. “That’s a continual problem that they’re solving, and there are no permanent solutions.””

Update: August 20, 2011

In our previous February article, below, on why Facebook does not want to go the traditional SEC-regulated IPO route, there is a related story about Groupon that supports our thesis. Groupon is struggling to go public after its shaky financials were made public during its attempt to go public. Here’s the story.

We continue to believe that many of the claims about Facebook’s true number of users, whether that number is decreasing, and the true profitability of Facebook, are metrics that the company does not want to reveal in an IPO process.

Update: June 19, 2011

We previously reported (below) that Facebook executives might be reluctant to take the company public via a normal IPO because the disclosure process would reveal truths about decreased usership that would damage the hyped valuation. A recent report by an Internet marketing firm that tracks Facebook users claims that Facebook lost 6 Million users in the U.S. in May. Growth for Facebook is coming from non-U.S. countries late to adopt. This is consistent with our own experiences.

BatteryPark.TV recently implemented a password-protected homepage that allowed Facebook users to login with their existing Facebook account. The residents of Downtown Manhattan revolted. Almost no one seemed to be a Facebook user. In addition, anecdotal feedback indicates that Facebook is not cool any longer with the youngest users. The Facebook overload phenomenon, see below, is genuine.

We continue to believe that Facebook missed the best window of opportunity to go public in 2007. Social networking IPOs LinkedIn and Pandora have both faired poorly this year. With the end of QE2 and the worsening economy causing the markets to correct, a successful IPO window is closing rapidly.

Update: March 8, 2011

CNN just posted a story “How much is Facebook really worth?”

At the time of our story on February 1, the entire mainstream media was doing nothing but positively hyping the potential and valuation of Facebook. Unique points made in our story back in February were that the parameters that would be used to value Facebook, that would have to be made public if they went IPO, might not support a $50 B valuation. Specifically, do Facebook users stop “clicking” after the initial excitement, due to Facebook overload? Are there really 500 Million ACTIVE users? If Facebook can no longer sell your personal information due to new laws or backlash, is Facebook worth anything more than a Huffington Post model? Was Goldman Sachs trying to sell yet another dog of an investment to its clients, ala Abacus?

February 1, 2011

Facebook recently tried to raise a reported $15 Billion in capital via a novel private offering of stock underwritten by Goldman Sachs. Goldman was then planning to sell those shares to select banking clients in a manner that would somehow not violate the SEC’s 499-shareholder limit and trigger a mandatory IPO.

The whole convoluted scheme became too controversial and Goldman Sachs cancelled the offering to U.S. buyers. Instead, non-U.S. buyers received shares, raising more than $1 Billion for Facebook.

Related, Groupon, Demand Media, and LinkedIn also backed away from planned IPOs. The full disclosure process of going IPO revealed that the companies were in fact losing money rather than profitable, as they claimed using clever accounting afforded to private companies.

Why is Facebook so reluctant to go the normal IPO route? What parameters on revenue, number of users, and clicks per month would stand up to GAP and Sarbanes-Oxley? Did Facebook miss the best window for IPO back in 2007?

If Facebook does not have a true active user base of 500 million people, a claim that would be scrutinized in public offering documents and have to be personally approved by the CEO Zuckerberg, that would indeed be a powerful reason to avoid an IPO. Likewise, for an advertising revenue model company such as Facebook, the unique user “clicks” per month is a crucial parameter that drives future revenue estimates and stock valuation. If the rate of active logins per Facebook user has peaked, that too would be a serious blow to the company valuation.

Many users of Facebook, of all demographics, will explain that they initially login and “click” around on Facebook far more in the beginning, then cool off. In fact, there might be a new burnout psychiatric syndrome called “The Facebook effect”, as reported on ABC news, whereby users start to dislike the Facebook experience.

Social networking, as a whole, is a new phenomenon that has come to mainstream only within the last three years. The Time Magazine 2010 “Person of the Year”, Facebook CEO Zuckerberg, was a choice recognizing that 2010 was the year social networking gained critical mass. As Saturday Night Live noted, even many “mothers” and grandparents are using Facebook.

Will the generations that use Facebook the most, those who collect hundreds of “friends”, suddenly tune out and make Facebook yesterday’s fad like sacral tattoos and Paris Hilton? Already, an ABC interview with the actors nominated for Academy awards this year revealed that none of them are on Facebook.

Is social networking really this vastly untapped mysterious space in which to invest? The major competitors to Facebook are not doing well. MySpace, owned by News Corporation, is laying off half of its staff and rumored to be on the selling block. Google and Apple both tried to start social networking sites and failed. If the social networking space is so wildly profitable, as Facebook claims, why have these otherwise successful companies failed?

The biggest threat to the entire class of “social network” companies is whether public outrage will grow over the egregious violation of privacy that is essential for the business models of the companies. The Wall Street Journal launched a series of “What they Know” stories exposing how Facebook collects personal information of users and then sells that to advertisers. The FCC has already introduced regulation to limit this activity, and congress might pass new bills with more teeth. That would be the death sentence to Facebook revenue.

More evidence that Facebook might be desperate to inflate “clicks” and daily activity is that it allows for countless bogus “celebrity” pages to exist. The young naive user who is accepted as a “friend” to a bogus impostor Gossip Girl actor page, for example, becomes excite and starts to use the site more. Facebook has sophisticated tracking algorithms and could shut down all of the bogus sites if they wanted to.

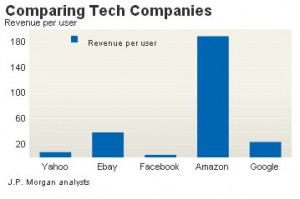

When Goldman Sachs first announced the plan to raise $15 Billion for Facebook via a private offering, the New York Times and Wall Street Journal calculated that the entire company was receiving a $50 Billion market capitalization value. The WSJ compared Facebook parameters to other companies such as Yahoo and Google and found major disconnects between the fundamental drivers of valuation and the actual valuation being assigned.

If Facebook was wildly overvalued at $50 Billion, why would Goldman Sachs sell shares to its most important clients? To answer that, one needs to look way back in history to 2010 and the congressional hearings whereby the Fabulous Fab sold “shitty investments” called Abacus to clients, while Goldman was internally shorting Abacus.  Goldman Sachs partners are under extreme pressure to perform. Failing to do so means that they lose Partner status. Given that there were no consequences to any individual at Goldman Sachs, and the CEO Lloyd Blankfein is now attending White House State Dinners, it is quite likely that the way of doing business at Goldman Sachs has not changed at all.

Goldman Sachs partners are under extreme pressure to perform. Failing to do so means that they lose Partner status. Given that there were no consequences to any individual at Goldman Sachs, and the CEO Lloyd Blankfein is now attending White House State Dinners, it is quite likely that the way of doing business at Goldman Sachs has not changed at all.

Let them eat cake. Sell them overpriced Facebook.