This post has been read 822 times!

January 6, 2022- by Steven E. Greer, MD

January 6, 2022- by Steven E. Greer, MD

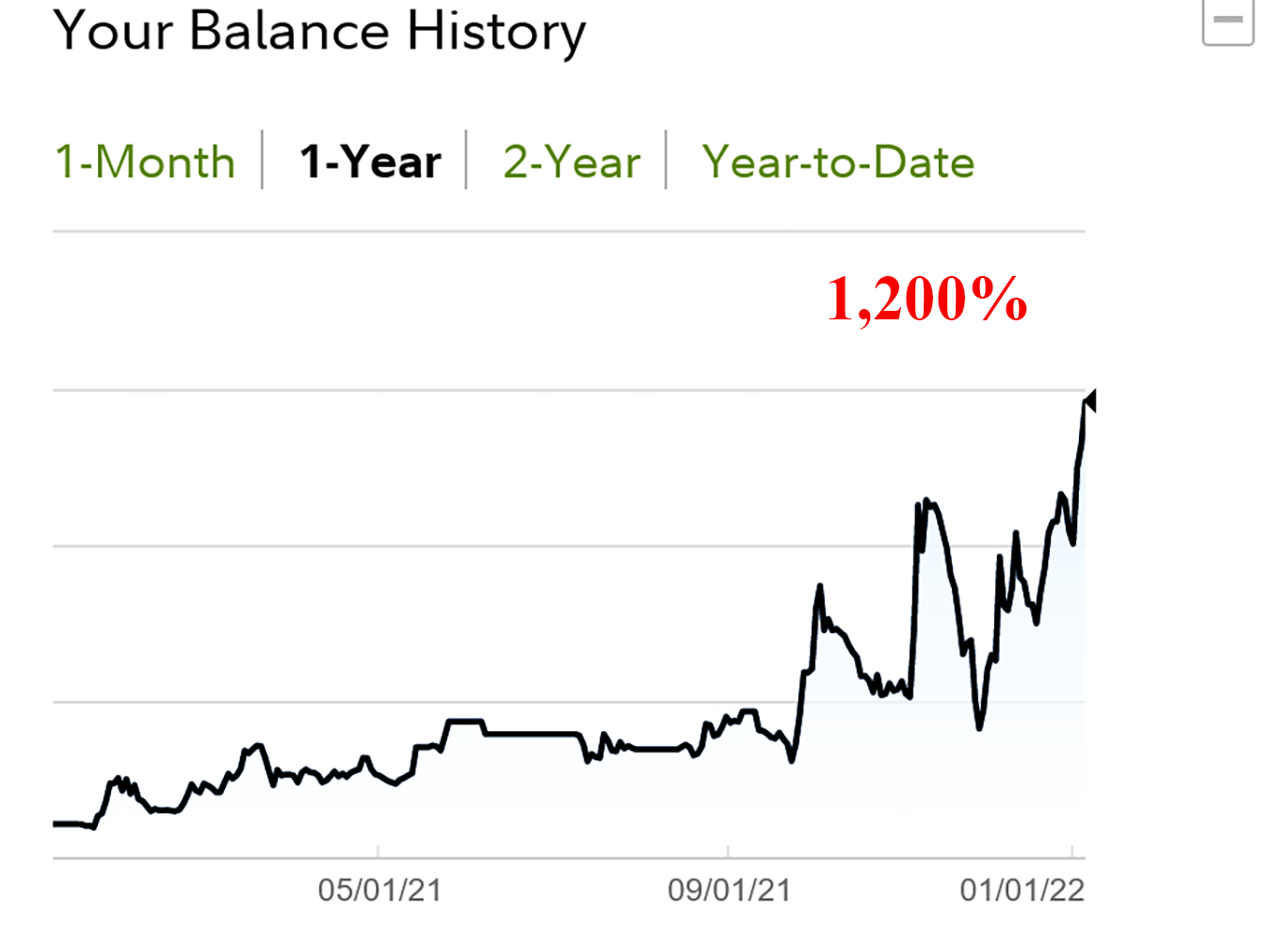

My personal portfolio grew by 1,200% in 2021. I never owned more than two stocks at any time. In other words, I was the antithesis of a “hedge fund”.

I started the year in AMC Theaters for fundamental reasons. I thought the lifting of the year-long pandemic would result in people go to the theaters. I was right. But I also got lucky in that AMC was a RobinHood meme stock. I doubled my money and sold it the day before it went up 1000%, so I missed out on millions. I got back into AMC and doubled my money again. I also dabbled in Smile Direct Club long.

Note, I was not using margin leverage. I got tired of my broker panicking and annoying me with arbitrary margin calls.

Then, in September, I saw that the vaccine stocks were wildly overvalued and people assumed the vaccines would be around forever due to boosters. I knew the vaccines were dangerous and no longer working.

I spotted this as a classic Greer-contrarian bet and I pounced. I am rather famous in Wall Street circles for thinking I am smarter than the entire markets and being vindicated. It takes a big ego, which I have.

However, it was too risky to short those names given the crazy trading of the year. Instead, I spent a couple of weeks speaking to my old Wall Street derivatives friends, learning how to place the best put options.

Well, I timed it perfectly, which is rare for me, and doubled my money again. Then, the stocks went up because of the Fall “fourth wave” of delta. Trading biotech names is not for the weak of heart. I stuck to my convictions, added more puts, and then doubled my money again. I rode that roller coaster a few times.

And here I am. In a year when most hedge funds lost money on shorts that cost them, I had to have posted one of the best performances around, including the day-traders who got lucking in AMC and GameStop. If I had not sold AMC at the wrong time, I would have been up several thousand percent.