This post has been read 2408 times!

May 4, 2014- By Steven E. Greer

May 4, 2014- By Steven E. Greer

The WSJ published a lengthy article on the calculations to determine whether renting or buying is the smartest option. Most people think that renters are poor losers. Actually, in many cities, including New York, the smartest financial experts rent because it makes the most sense.

Making the case for renting even more compelling is when the individual can earn more of a return on investing in other assets, such as stocks. For professional stock-pickers who can earn double-digit returns, it makes no sense at all to tie up capital in the form of low-return real estate.

The cost per month to own an apartment in New York that rents for $3,000 is easily $5,000 when the exorbitant monthly management fees are added. The money saved renting can be turned into far more profitable investments in the stock market, for the professional investor. However, “Mom and Pop” are often better off sticking to simpler real estate as their main investment.

Excerpts from the WSJ are, “People often aspire to own a home for reasons that have little to do with money, and rental options are limited in some communities. Yet owning property can limit your flexibility to move when you want and ties up a lot of your money.

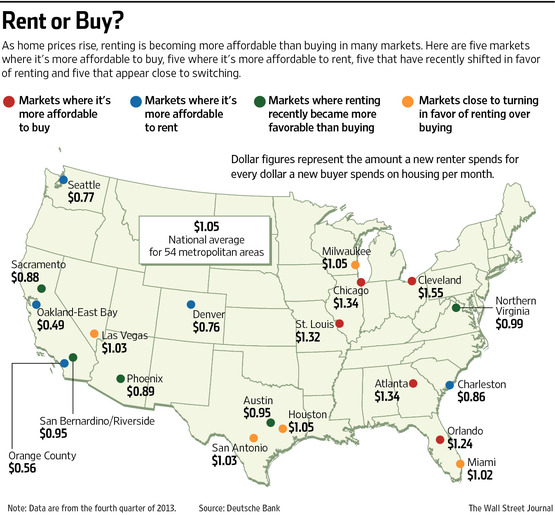

The monthly cost of renting was lower than buying in 20 large metropolitan areas at the end of last year, the most recent period for which data are available, according to figures provided exclusively to The Wall Street Journal by Deutsche Bank. That is up from 15 large metropolitan areas a year earlier.

Many homeowners also can deduct mortgage interest from their income-tax bills along the way.

In addition, homeowners can tap into the equity in their homes for big-ticket expenses, such as college tuition, at interest rates that can be lower than other financing options—though that can backfire by saddling homeowners with debt they can’t easily repay.

Homeowners also don’t have to worry about a spike in rents. Jacquelyn Bilton, who is 34 years old, bought a three-bedroom home with a pool in Margate, Fla., in February for $200,000, after her landlord raised her rent 28% last year. She says her monthly housing costs are now about $300 lower.

Renters don’t end up with a valuable asset, as buyers do when they pay off a mortgage. But renters might be able to make more money by investing the monthly savings, as well as the cash they would otherwise use for a down payment, he says.

After moving to New York two years ago, Hunter Kearney, 27, looked into buying a condominium worth at least $2 million. But Mr. Kearney, an executive at a firm that sells graphite, concluded that renting a similar apartment was significantly less expensive.

“Your monthly costs end up being lower,” says Mr. Kearney, who says he saves about $2,000 a month over the cost of buying. He is investing some of the savings in the stock market.

Renters often have greater flexibility to move to a different part of the country, which can be important in a weak job market. They may feel freer to look for work in another city, and they don’t have to wait to sell their home if the right opportunity opens up.”