This post has been read 2994 times!

June 30, 2011

For the average American who can’t even determine that a progressive “sub-prime” mortgage is a trap, anything financial is intimidating and foreign. Only buzzwords like “Goldman Sachs”, “Wall Street”, or “bailout” strike a resonating chord that triggers knee-jerk rage powerful enough to throw out incumbents in 2010 and catapult Michele Bachmann to the head of the pack.

To the typical moron, baseball steroid taker Mark McGwire, Governor Blogojevich, or the corner crack dealer are more deserving of prison than Dick Fuld, Stan O’Neill, or Angelo Mozilo. That’s because the media covers those pop culture topics more, and the masses can’t comprehend the immensity of the crime that the incompetent captains of Wall Street perpetrated when they loaded up on toxic debt CDO’s.

The numbers “one-trillion” and “one-billion” are equivalent in most minds and the terms are confused on national TV regularly. There is an estimated $600 TRILLION in outstanding derivatives around the world: a number that no human can comprehend.

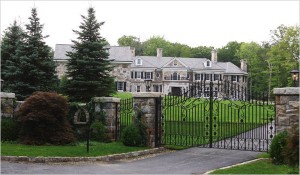

In this environment, the richest men in the world operate in anonymity managing “hedge funds” from places like Stamford and Greenwich, Connecticut, or Manhattan. The U.S. congress rarely vilifies them like “Goldman Sachs” because they donate too much to campaign funds of both parties. If the public knew that they reaped billions in profits while shorting the banks and home lenders, would they at least be more outraged that these same billionaires pay only 15% tax on their largess? (No judgment on low tax rates is being made. One could argue that everyone should pay lower tax rates).

In the news today is rare negative publicity about a billionaire hedge  fund manager, David Tepper of Appaloosa Capital. While in the luxurious Hampton’s, he apparently discarded (intentionally?) his ATM receipt that flaunted a $100 Million dollar balance in his partially-owned bank account at Capital One.

fund manager, David Tepper of Appaloosa Capital. While in the luxurious Hampton’s, he apparently discarded (intentionally?) his ATM receipt that flaunted a $100 Million dollar balance in his partially-owned bank account at Capital One.

The timing could not have been worse. George Stephanopoulos of ABC’s GMA quipped that President Obama was referring to hedge funds like David Tepper’s when he referenced “billionaires” in his pursuit to raise taxes during the ongoing budget deficit battle.

The timing could not have been worse. George Stephanopoulos of ABC’s GMA quipped that President Obama was referring to hedge funds like David Tepper’s when he referenced “billionaires” in his pursuit to raise taxes during the ongoing budget deficit battle.

Rage against TARP “Wall Street bailouts” amidst high unemployment is a source to tap into for political wins. If congress and the presidential candidates start to go after hedge funds and use gaffes like the Tepper wealth flaunt, angry mobs with pitchforks might convene upon Stamford. (To no avail as their retired law enforcement security guards beat them away)