This post has been read 2039 times!

January 11, 2014- By Steven E. Greer, MD

January 11, 2014- By Steven E. Greer, MD

Disgraced Wall Street sell-side technology sector analyst, Henry Blodget, who was banned for life by the SEC from working in Wall Street, is making a comeback in tech by running a news aggregation site called Business Insider. It has funding from Tech Titans, such as Jeff Bezos of Amazon.com, The Huffington Post, and others.

Mr. Blodget was interviewed by Charlie Rose, and Charlie asked him whether the tech stocks are in a bubble again, ala 1999. He dodged the question, but then went on to claim to be a current prognosticator of an overall stock market bubble yet to burst. Perhaps hoping to vindicate his “pump and dump” reputation earned in the last tech bubble, he bemoaned to Charlie Rose that he wish he had called it a bubble at the top in 1999.

Meanwhile, Mr. Blodget refused to label tech stocks, such as Twitter (TWTR), as being bubble-valuation equities, despite Twitter having a market cap of $40 Billion in December of 2013 (it has already fallen 25% in valuation to $30 Billion, in less than a month).

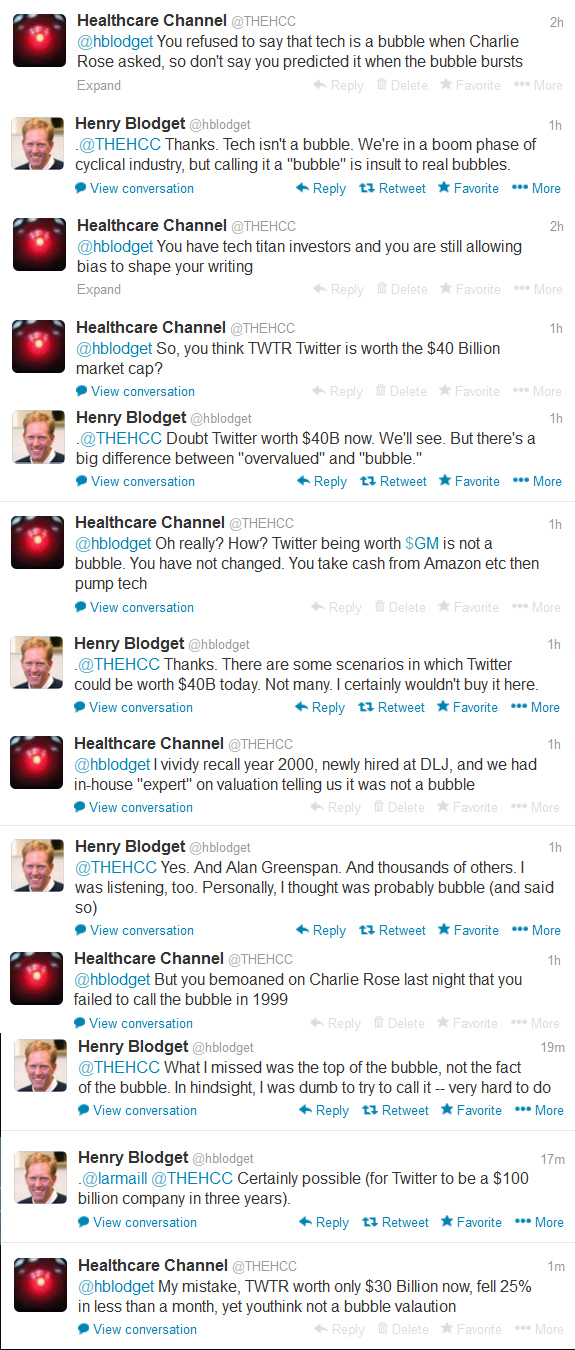

We decided to seek some answers from Mr. Blodget via the Twitter venue. After a 12-hour delay, he did engage us in an interview, see below: