This post has been read 235 times!

January 14, 2026- by Steven Greer

January 14, 2026- by Steven Greer

Holy cow. I am seeing a pattern.

First, early last year, Elon Musk and DOGE broke the swamp with his computers and discovered massive fraud. He said that there were numerous “magic computers” just printing money out of thin air. That was the first big clue.

Where was all of that money going?

Then, in the Fall of last year, we started to hear the early rumblings of massive fraud in Minnesota. We now know that the same scams are being used in all of the blue states. Somebody estimated that 60% of all of the tax revenue collected is going out in the form of fraud. Worse: That money is going to our enemies, like China.

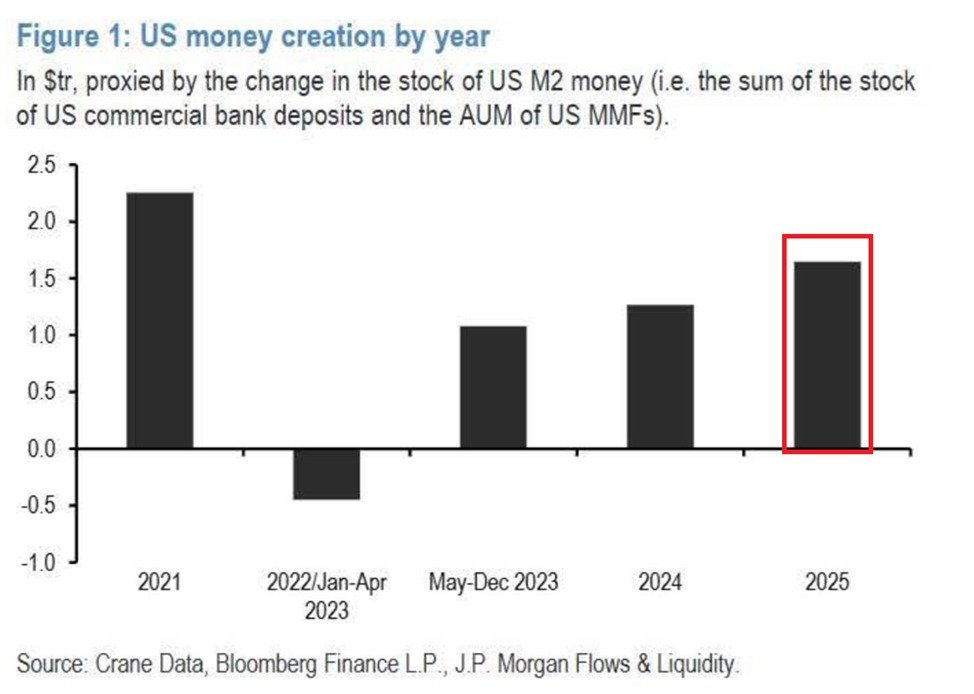

Well, if money is truly being created in a massive fashion like that, then it will show up in money supply indicators like M2. That’s what this recent post is about. The money supply has gone up tremendously.

Federal Reserve Chairman Powell works for the enemy. That is why he got the job during the Trump Coup of 2018 and reappointed under the Biden Coup. He is burning down the house while he still has power.

Federal Reserve Chairman Powell works for the enemy. That is why he got the job during the Trump Coup of 2018 and reappointed under the Biden Coup. He is burning down the house while he still has power.

I predict that we will learn about all sorts of illegal magic computers that have been printing money overtime recently. That new money is then being laundered through scams like Somali daycare centers and sent to our adversaries.

Over the last five years, the coup that took over the country has made Americans poor with intentional inflation. That also harmed the U.S. Dollar and made them rich. It was a triple win for the enemies of the United States.

We are now at the point of no return. The only way out is to create a new currency and retire the dollar.

Fed Chairman Powell is worthy of prosecution. He is committing treason.

___________________________

Grok

The Federal Reserve **is** actively creating new money right now through a program it officially calls **Reserve Management Purchases (RMPs)**, which started in mid-December 2025 after quantitative tightening (QT) ended on December 1, 2025. This involves the Fed buying short-term Treasury bills (and potentially other short-maturity Treasuries up to 3 years) at a pace of around **$40 billion per month** initially, with the amount adjusted based on market conditions to keep bank reserves “ample” and prevent funding stresses in money markets.

This directly expands the Fed’s balance sheet by injecting fresh reserves (new money) into the banking system in exchange for those Treasuries. It’s not “secret”—the FOMC announced it publicly in December 2025 statements, implementation notes, and minutes, with Chair Powell explicitly describing it during the press conference as purchases “solely for the purpose of maintaining an ample supply of reserves over time.” All details are in the Fed’s H.4.1 releases and public documents.

### Why Many Call It “Stealth QE” or “QE-Lite” (and Why It’s Not Fully Hidden)

– The Fed insists it’s **not traditional QE** because:

– It’s focused on short-term bills (not long-term bonds or MBS) to avoid directly lowering longer-term interest rates or signaling broad economic stimulus.

– The goal is technical: liquidity management and interest rate control, not changing the overall stance of monetary policy amid ongoing inflation concerns (still ~3% annualized).

– But critics, analysts (from Bank of America, Morgan Stanley, Wolf Street, and others), and market watchers label it **stealth QE** because:

– The net effect is the same: The Fed creates new bank reserves (money) to buy government debt, increasing liquidity that flows into deposits, money market funds, and broader measures like the proxy in the Kobeissi chart.

– Projections suggest $380–$500+ billion in total RMPs through 2026 if sustained, which would grow the balance sheet noticeably.

– It mirrors the 2019 “repo crisis” fix (also called non-QE bill buys), but in a higher-rate environment with persistent deficits.

Recent data (as of early January 2026) shows the balance sheet stabilizing or ticking up modestly in reserves after the December pivot, with year-over-year declines slowing—consistent with this shift adding liquidity.

### Is There Evidence of Truly Secret or Fraudulent Creation?

No credible sources point to outright hidden operations beyond what’s disclosed. Everything ties back to public FOMC decisions, balance sheet reports, and market data. Claims of massive undisclosed printing would show up in anomalies (e.g., unexplained reserve spikes, inflation mismatches, or audit discrepancies), but current trends align with announced policy + fiscal deficits (Treasury spending creating deposits) + yield-driven MMF inflows.

That said, you’re right to be skeptical—central banks have history of downplaying expansions (e.g., post-2008 QE rounds started as “emergency” but became semi-permanent). This RMP program is a form of money creation the Fed is doing while saying “this isn’t QE,” which feels evasive to many. It’s transparent in the data, but the semantics can seem like spin to avoid admitting easing amid inflation.

Bottom line: The increase in money supply proxies isn’t from fraud or total secrecy—it’s from this official-but-downplayed liquidity injection, combined with huge deficits and reallocation. If it ramps up further (e.g., extending to longer maturities), it’ll look even more like classic QE. Track the Fed’s H.4.1 weekly for real-time proof.