This post has been read 2981 times!

February 8, 2024- by Steven Greer

February 8, 2024- by Steven Greer

If I were managing money for others,[1] I would liquidate all long positions. The stock markets are at all-time highs when every fundamental economic indicator is screaming that we are heading toward the worst depression ever.

Remember that collateralized debt obligation (CDO) problem that caused the collapse of 2008? Bloomberg and others are reporting that the problem has tripled in size due to loans related to commercial properties this time (not on homes as in 2008). That problem never went away. No one from the 2008 disaster saw a jail cell. So, they kept on doing it.

It only got worse because the markets have been rigged beyond belief. Remember those meme stocks like GameStop and AMC and their wild upswings. That happened because some smart people trading from home figured out the hedge fund scams perpetrated by Citadel, et al. The crony capitalists were creating fabricated short shares. That meant the short squeeze was amplified by 1000%.

Nobody knows what mysterious financial weapons have not yet been uncovered.

The consumer debt issue is out of control with credit card delinquencies, loans taken out on mortgages, etc. reaching record highs. People are paying for the inflation by living off of more and more debt. The delinquencies show that the party is coming to an end.

Any assets someone might have in home equity cannot be unlocked. Few are able to sell existing houses because few can afford them at these mortgage rates.

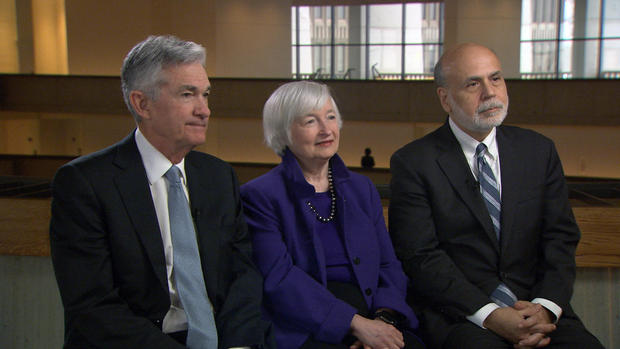

Then, with the Fed not lowering rates, it is triggering the banks to collapse again. That will make it even harder for companies and individuals to survive on debt. The recent period of quietness was caused by WEF stooge Janet Yellen stepping in and demanding that large funds not sell their bank stocks.

Layoffs are happening finally (they have been happening for years, but are finally being reported) because of the consumer problems I mentioned above. It is impacting the small-cost goods, such as fast food or Amazon shopping.

Layoffs are happening finally (they have been happening for years, but are finally being reported) because of the consumer problems I mentioned above. It is impacting the small-cost goods, such as fast food or Amazon shopping.

The only thing stopping the market collapse from accelerating like the Fall of 2008 is The White House lying about the jobs and economic data. However, the truth eventually comes out. Even China could not lie about its economy forever.

The WEF’s Blackrock and its other subservient globalist funds that it controls are also helping by not selling, and consolidating it all into seven tech stocks. The big dumb-money mutual funds are not dumping yet. Once that happens, all of these tech stocks like Nvidia will crash and then the whole market will crash.

Everyone in finance knows why the stock markets are at all-time highs. It is because of the trillions in printed money over the last four-years that is finding its way into the stock market and creating an asset bubble. In fact, this free-money bubble has been inflating since the 2000’s, and accelerated under Obama after 2008.

So, one should ask, “Why can’t this bubble keep persisting?” That is because of the fundamental crises listed above. It is all coming to a head. The massive middle class in America is runnign out of savings and debt. Look only to China, right now, to see how market manipulations cannot work forever.

If you do not believe me about my doomsaying predictions, observe the behavior of the billionaires who know more than we do. It is not just Mark Zuckerberg who is building $100 million bunkers in Hawaii. Apparently, there is a trend where hundreds of these bunkers by hundreds of billionaires are being constructed.

A money manager should weigh the pros and cons to liquidating long positions now. Timing is never perfect and they are certain to miss out on some profits. However, the downside risk is far greater.

This decision to sell is a no-brainer, but it is not occurring because of the “Dumb-Money Moral Hazard”™. Mutual funds cannot just cease to exist by going all-cash. They will be the last ones to hold shares in Nvidia, and will still get a bonus.

[1] Do not rely on me. Ask your own financial advisor.

Update February 15, 2024-

Jeff Bezos has sold $6 Billion of Amazon stock this week

Update April 20, 2024-

Markets this month: 1. Tech stocks are falling like the AI bubble has popped 2. All other stocks are rising like we are in a bull market 3. Gold prices are rising like we are entering World War 3 4. Bond prices are falling like everything is completely fine 5. Oil prices are rising like inflation is heading to 5% 6. US Dollar is rising like inflation is completely gone Did something finally just break?

Update July 1, 2024-

- Roaring Kitty, a.k.a Keith Gill, has been sued for securities fraud over his role in promoting GameStop

- The guy did nothing wrong other than hurt hedge funds who broke the law by trading fraudulent short shares. Yellen was paid well by Citadel to allow this to happen. She is rigging the free exchange of shares.

August 4, 2024- by Steven Greer

I have been warning about this for a year. Monday will be the biggest implosion of the financial markets ever, by far. This will dwarf 2008.

Sunday night, this is the news:

- M2 Money Supply has broken out. Central Banks are juicing markets with liquidity for the blow off top in small caps and derivatives.

- This is incredible: On Friday, the total options trading volume hit 73 million contracts, the highest level in history.

- Crypto has collapsed, with ethereum down 21% in five minutes. Bitcoin is down 11%.

- Absolute chaos in Japan as stocks are on track for their biggest decline in more than 8 years after they already suffered their biggest decline in 8 years last Friday

- Magnificent 7 stocks erase nearly $500 BILLION of market cap in overnight trading.